75% of non-homeowners say that owning their own property is their ‘American-dream’, according to Stratmor Group. However, prices are rising fast; the median price of a property in some states in America has increased by more than 10% in the past year. But there’s no need to let surging house prices put you off from owning your dream home, as these steps will ensure you soon become the owner of a stunning property.

Think positive

Studies such as the one conducted by Harvard which revealed that 40 million U.S. citizens can’t afford the property they live in, encourage a poor mental attitude when it comes to home ownership. But owning your dream home is possible, no matter what your finances. Positivity is the key to home ownership as it encourages you to save more money. You’ll only be able to get in this mindset once you’ve eliminated all debt, so focus on this initially. Surrounding yourself with people who think positively about money is a must, too. It’s easy to feel down when you have to turn down an invite from friends due to money, but by proudly explaining why you can’t go out and your end dream, you’ll feel much happier about the situation.

Set realistic goals

Setting realistic housing goals will help you achieve your dream home in record time. First of all, speak to a mortgage advisor or mortgage lender about how much you can afford to borrow and how much down payment you’ll need to secure your dream home. You’ll probably work non-stop during the week to keep the money rolling in and think do mortgage lenders work on weekends? The good news is that there are a variety of mortgage lenders out there who work different shifts. Some will happily assist at the weekends, while others will be weekdays only. After speaking to them, rather than focusing on having to save $30,000 for example, concentrate on saving $500 per month for 5 years. This is much less daunting and will help you to stay fixed on your end goal.

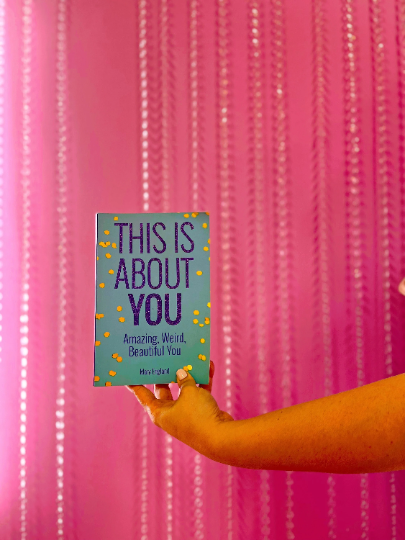

Visual reminders

Visual reminders work by prompting you to work towards what you want. For example, you could stick an image of your ideal home to the front of your fridge so that you see it multiple times per day. A mood board in your current living area or by your bed showing your favorite home furnishings will push you to keep saving too as you’ll constantly be reminded of your future. This is beneficial as research shows that consumers who plan ahead make better financial decisions than those who act on impulse. Post it notes and note cards are even simpler and can be just effective, particularly when you use uplifting words and positive colors on them, such as orange, pink, and red.

Being able to afford a beautiful property can be a daunting prospect. But lots of positivity, along with a change in your spending and saving habits, will earn you your dream home promptly.